Short answer:

Yes — Turo can still be profitable in 2026, but profitability is not automatic. Profit depends on choice of vehicle, market, pricing strategy, protection plan, operating costs, and how data-driven you are. Hosts who treat Turo like a business — analyzing local demand, managing costs, picking the right protection plan, and optimizing listings and delivery — still make solid ROI, while those who guess often lose money.

Contents:

This guide provides a full picture: platform context, real costs, example math, market signals for 2026, EV vs gasoline tradeoffs, host case studies, step-by-step profitability checks, and how tools like RentScout help hosts make informed decisions without guesswork.

Why 2026 Is a Different Year for Turo Hosts

Turo as a business has matured significantly. The company reported nearly $958M in revenue for 2024 and has been EBITDA-positive in recent years. The platform continues investing in reach and integrations, making it more robust for hosts.

A major change in late 2024 / early 2025 was Turo’s partnership with Uber. Now Uber users can find and book Turo cars through Uber Rent, bringing meaningful new demand and discovery for hosts.

Additionally, Turo rolled out platform features like dynamic pricing and refined protection plans and analytics for hosts. These tools reduce guesswork and make markets more efficient and competitive.

For hosts, this means more demand and marketing reach, but also more competition. Profitability is achievable — but it relies on informed decisions, not luck.

How Turo Pays Hosts

Two simple factors determine your top-line revenue:

- Gross bookings = daily rate × days booked.

- Host take rate = the share of the trip price after Turo’s protection plan and platform fees.

Turo provides multiple protection plans, which set your earnings percentage and deductible: 60%, 75%, 80%, 85%, and 90% host earnings, with higher deductibles for higher earnings. Optional extras and platform fees also affect net revenue. In short:

Net profit before tax = gross bookings × host take rate − operating costs.

Operating Costs Every Host Should Model

Many new hosts underestimate expenses. Key recurring and non-recurring costs include:

- Insurance: Off-trip coverage starts at $56/month and can be higher depending on vehicle and location.

- Car washes/valeting: $25–$30/month with local monthly plans.

- Maintenance: Gasoline vehicles $300–$800/year; EVs $150–$400/year.

- Annual Turo inspection: ~$25/year.

- Storage/parking: $0–$200/month depending on location.

- Delivery costs: Uber/Lyft or paid driver if offering delivery.

- Loan/financing payments: If the car is financed.

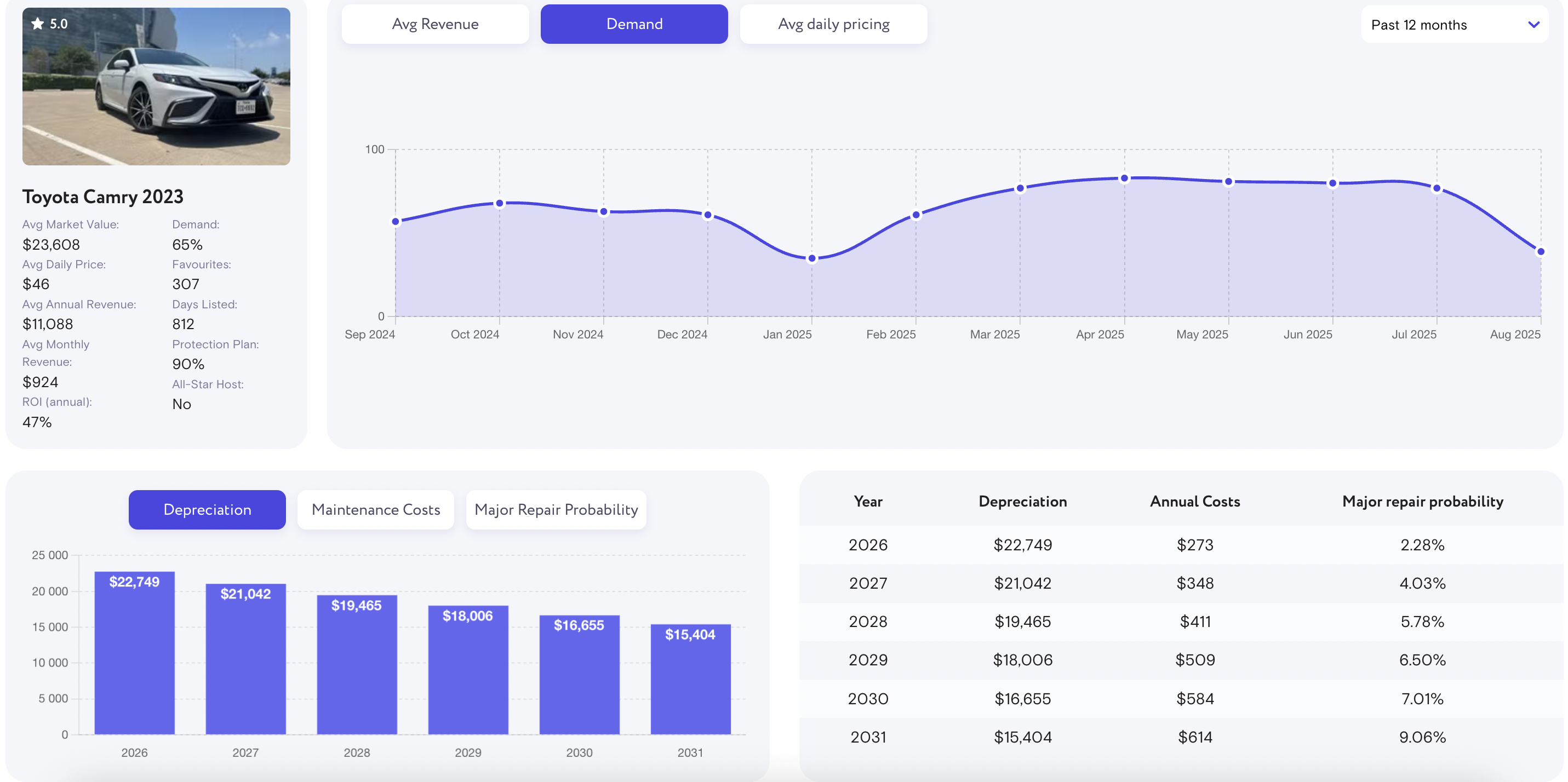

- Depreciation: Essential for ROI; vehicles lose value each year.

- Unplanned costs: Accidents, repairs, fines, roadside assistance, and lost rental days.

Operating costs, depreciation, and financing are often the largest margin killers if overlooked.

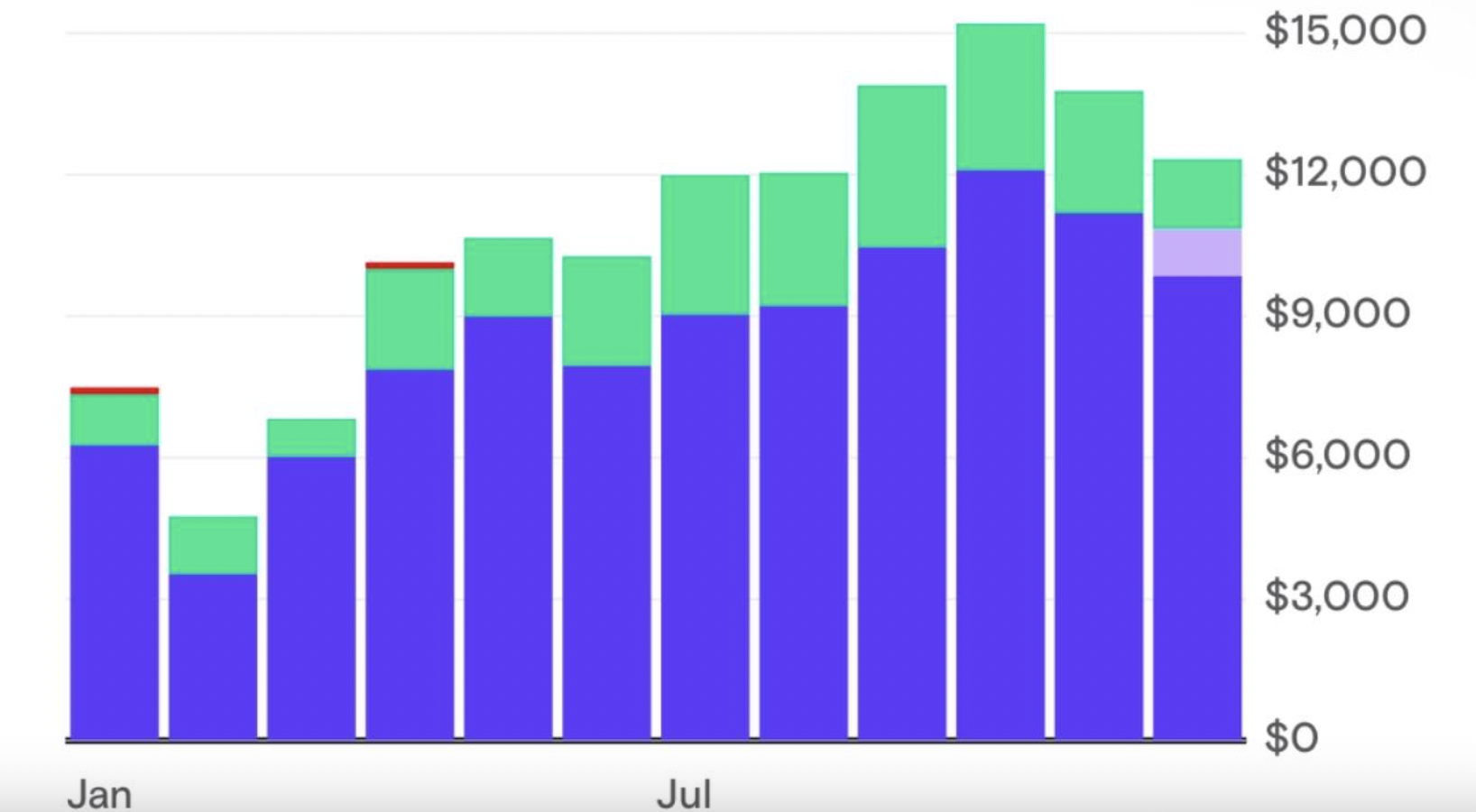

Practical Budget Example

Here’s a simple example using realistic numbers:

Vehicles:

- Tesla Model 3 (used, $22,000)

- Toyota Camry 2019 ($17,500)

Monthly revenue:

- Model 3: $1,016

- Camry: $940

Costs:

- Off-trip insurance: $56/month

- Car wash: $30/month

- Maintenance: Model 3 $300/year, Camry $700/year

- Annual Turo inspection: $25

- Depreciation: Model 3 $3,000/year, Camry $2,000/year

Host take rates: 75% and 90% plans

Step 1 — Annual gross revenue:

- Model 3: $1,016 × 12 = $12,192

- Camry: $940 × 12 = $11,280

Step 2 — Host earnings after protection plan:

- 75% plan: Model 3 = $9,144, Camry = $8,460

- 90% plan: Model 3 = $10,973, Camry = $10,152

Step 3 — Subtract annual operating costs:

- Model 3 = $1,357/year

- Camry = $1,757/year

Step 4 — Add depreciation:

- Model 3 total economic cost = $4,357

- Camry total economic cost = $3,757

Step 5 — Annual net profit:

- 75% plan: Model 3 = $4,787, Camry = $4,703

- 90% plan: Model 3 = $6,616, Camry = $6,395

Step 6 — Simple ROI:

- Model 3 ROI: 21.7% (75%), 30.1% (90%)

- Camry ROI: 26.9% (75%), 36.5% (90%)

Even with modest revenue, both cars are profitable under these assumptions. Financing or higher maintenance can lower ROI.

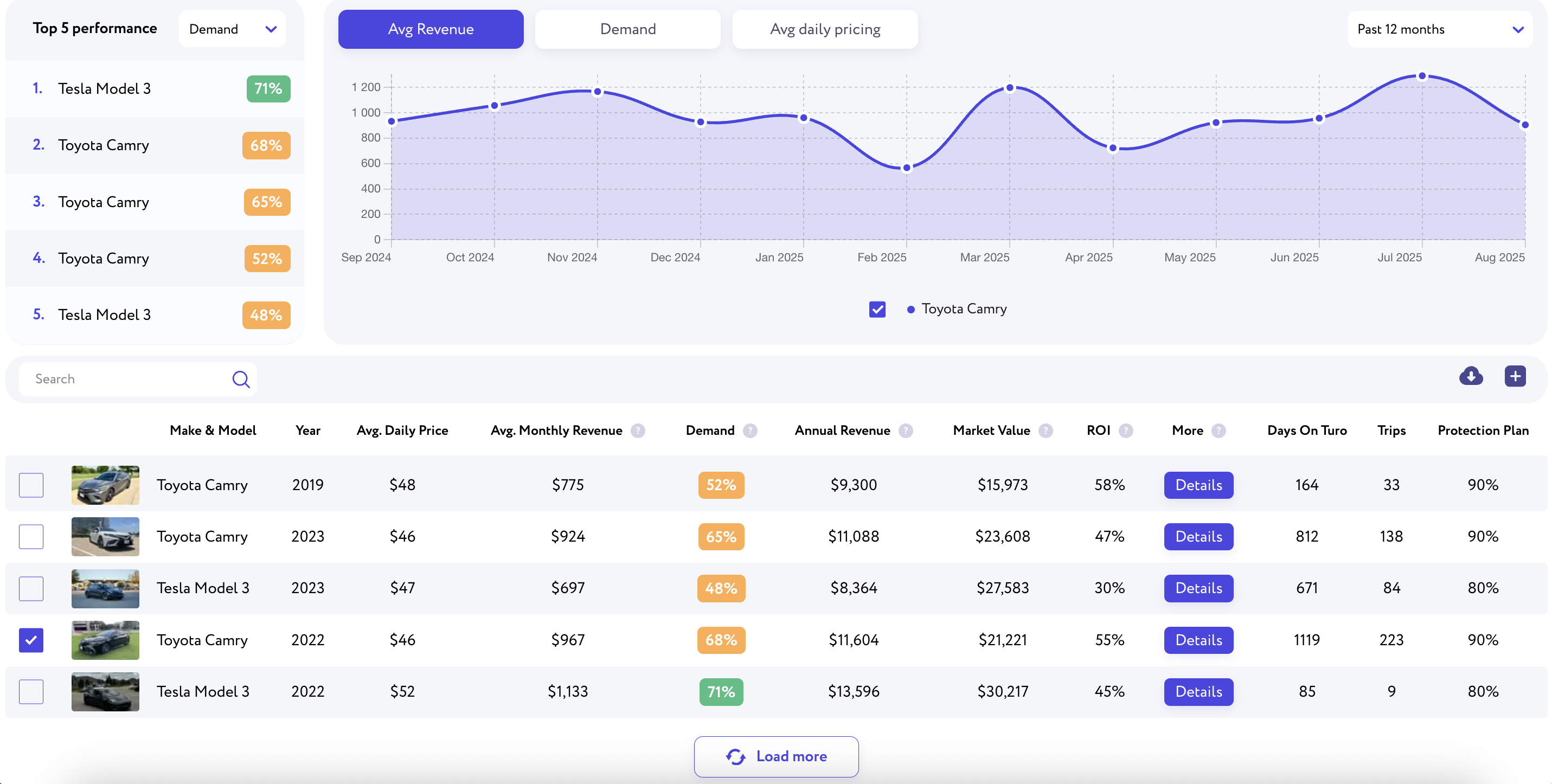

Tip: Use RentScout for precise revenue, depreciation, and maintenance data by model and location.

Market Trends and Public Data

Turo’s growth brings more customers but also more competition. The Uber partnership increases inventory visibility, especially at airports, generating incremental bookings. Dynamic pricing helps optimize revenue but requires host oversight during events.

Common Profit Traps

- Buying luxury/cool cars without analyzing demand: Mid-range vehicles often generate higher net income due to higher occupancy.

- Underestimating depreciation/repairs: Always model net revenue, not just gross bookings.

- Choosing the wrong protection plan: High-earning plans with large deductibles can be risky for new hosts.

- Ignoring delivery/listing convenience: Airport delivery and flexible pick-ups increase bookings.

- Overlooking financing costs: Loan payments can quickly erase profit.

EV vs Gasoline: What Hosts Should Know

EV Advantages: Lower maintenance, appealing to eco-conscious renters, sometimes higher pricing.

EV Challenges: Charging logistics, higher upfront cost, potential lost availability due to charging needs.

Gasoline vehicles are simpler for daily operations but require regular maintenance. A mixed fleet can optimize occupancy and costs.

Step-by-Step Profitability Check

- Analyze local listings for revenue, occupancy, and daily rates.

- Estimate gross monthly revenue = booked days × daily rate.

- Select protection plan (75% recommended for new hosts).

- List operating costs: insurance, cleaning, parking, delivery, maintenance.

- Model depreciation (estimate 10–20% first year).

- Compute net profit = host receipts − operating costs − depreciation − loan payments.

- Calculate ROI = net profit ÷ purchase price.

- Run sensitivity analysis: drop in occupancy, major repairs, etc.

Practical Strategies for 2026

- Start with 1–2 vehicles and iterate.

- Prioritize ROI over vehicle “coolness.”

- Use RentScout for revenue, demand, depreciation, maintenance, and protection plan data.

- Offer airport delivery and 24/7 pick-up to maximize bookings.

- Monitor dynamic pricing and adjust for local events.

Host case studies:

- Los Angeles: New cars priced too high = low occupancy, poor ROI.

- Louisville: Cash purchases in lower-competition market = fast ROI (<1 year).

- Miami: Airport-based SUVs + seasonal convertible = optimized occupancy and revenue.

Monitoring Metrics

- Weekly: Occupancy, upcoming events, competitor prices.

- Monthly: Gross revenue vs projections, maintenance, protection plan costs.

- Quarterly: Depreciation trends, ROI vs alternative vehicles, re-evaluate protection plans.

RentScout simplifies this workflow, providing model-specific, location-based revenue, demand, depreciation, and maintenance data.

FAQ

Q: Can a single-car host be profitable in 2026?

Yes, if the vehicle, protection plan, and operating costs are carefully chosen.

Q: Should I choose EV or gasoline?

Both can be profitable. EVs reduce maintenance but require careful charging management.

Q: Which protection plan is recommended?

75% plan for beginners; experienced hosts can explore 80–90% plans.

Q: Are some cities too competitive?

Yes. Saturated markets may yield low ROI; smaller markets can be highly profitable with the right vehicle.

Final Checklist Before Buying Any Car

- Pull revenue, demand, ROI, depreciation, and maintenance risk.

- Run optimistic, base, and pessimistic booking scenarios.

- Factor insurance, cleaning, delivery, parking, maintenance, inspection, and loan payments.

- Include depreciation in ROI math; avoid vehicles that produce negative ROI in realistic scenarios.

- Decide protection plan per vehicle.

- Launch with quality photos, airport delivery, and 24/7 pickup.

- Re-evaluate monthly and treat Turo as a business.

Conclusion

Turo remains profitable in 2026 for hosts who operate like a business. Platform growth, Uber integration, and dynamic pricing increase opportunity, but competition and market efficiency have grown. The winning hosts:

- Analyze local data (revenue, demand, depreciation)

- Price and protect vehicles correctly

- Control operating costs

- Optimize delivery and listing convenience

Tools like RentScout (a Google Chrome extension for laptops) remove guesswork, letting you choose vehicles with the highest modeled ROI for your market. Profit is still achievable — but only for hosts who plan, monitor, and act strategically.